Slippage

CivTrade innovates DeFi trading: start multiplying your gains today!

What is slippage

In markets with high volatility or low liquidity, as typical with DeFi trading, slippage occurs when trades settle for a different price other than the one ordered by the trader.

Imagine you place a buy order on Uniswap for $100,000 worth of $CIV using $ETH at a price of $100, but the order executes at $103 instead. What happened?

It may take seconds or even minutes for your order to be executed upon being submitted on the blockchain. This is a necessary feature of the blockchain: your order does not get executed immediately, it is placed in a queue that contains all orders on that respective blockchain, called mempool.

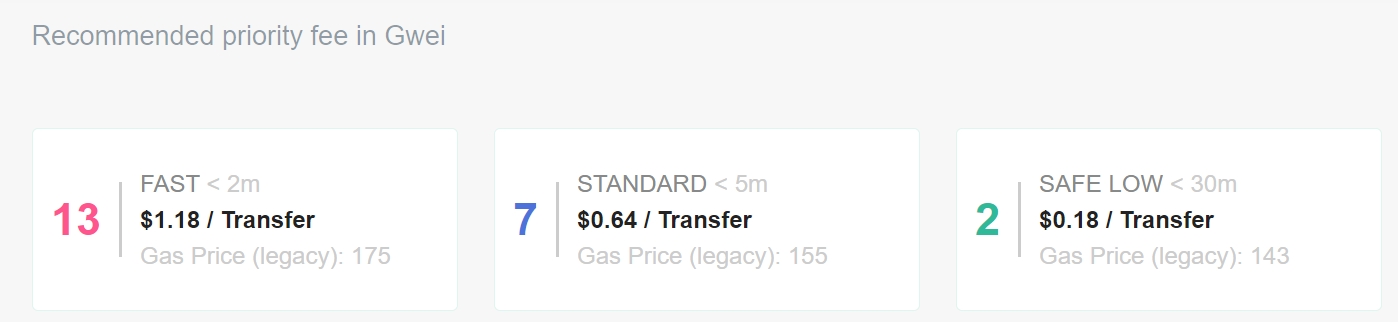

Orders are picked up by miners for execution in sequence, based mainly on gas prices, similar to an auction: high gas executes faster, low gas slower. Miners love profit too. Therefore, if you specify a relatively high gas price, and the queue is empty (i.e. low trade volume), your order will be picked up quickly. However, in general, the blockchain is becoming increasingly popular and many people are competing for the same limited computing capacity on the Ethereum network, driving up mining demand and thus gas prices.

See how “fast” corresponds to “<2m” (minutes)? What happens in those two long minutes before your order is executed? The market price of the token you are swapping for may very well have changed since any order changes the price. This is the primary cause of price slippage in DeFi.

Slippage doesn’t necessarily mean that you’ll end up with a worse price than expected. Positive slippage can occur if the market price lowers while you make your buy order (or increases on a sell order), which may occur especially in highly volatile markets.

Slippage tolerance

Slippage is like a trading tax imposed on traders that use market orders, which have so far been the only type of order offered in DeFi. Decentralized exchanges like Uniswap and ShibaSwap allow you to define a maximum slippage tolerance level. This value is expressed as a percentage.

A low slippage runs the risk of preventing the order from executing, as the market may have moved beyond the limit set in the order by the time the blockchain processes it. The blockchain will consequently “revert” the order, though unfortunately still consume gas fees.

On the other hand, a high slippage runs the risk of causing front-running. Automated bot are known to look for pending orders with high slippage tolerance and front-run them, causing you to lose that entire 5%. (Read this article later in our series to learn more about front-running.)

To mitigate the risk associated with slippage, especially with low-liquidity assets, you can break your desired buy/sell quantity up into multiple orders of smaller position sizes. However, doing this will require paying gas multiple times while increasing the risk of large price impacts.

Slippage is like a trading tax imposed on traders using market orders, which have so far been the only type of order traditionally offered by exchanges like Uniswap and Shibaswap.

Unfortunately, there hadn’t been an optimal solution to this problem for so many traders for so many years. Fortunately, CivTrade has changed all of that.

CivTrade eliminates your slippage

CivTrade eliminates slippage on decentralized exchanges like Uniswap or Shibaswap.

CivTrade opens a one-sided liquidity pool on Uniswap v3, within a defined range around the price your order is set for. One-sided means that, unlike traditional liquidity pairs, we can now deposit just a single token in your pool, hence one-sided.

So now what does this mean for you? Slippage is not a problem for CivTrade and, more importantly, you, if you use it. Absolutely zero%!

Let’s assume you want to buy CIV using ETH as the exchange token. Your target price determines the amount of CIV token you want in exchange for each of your ETH, for example a target price of 4,000 means you want 4,000 CIV for each ETH. The smart contract of CivTrade therefore opens a single-sided liquidity pool on Uniswap v3 at exactly the price range you determined, and this will guarantee an exact execution, without any slippage!

Upon completion of the transaction (which happens when the market moves to your order price), each ETH deposited you will have the target price ordered of CIV ready to withdraw.

Congratulations, you successfully completed the first true limit order on a Decentralized Exchange!

Your gains

Your CivTrades earn liquidity fees on each trade against your back-end liquidity position, including those generated by bots, sandwich attacks, front-running and arbitrage. Not only will you benefit from zero slippage, but also earn fees from humans and bots together!

This solves the lack of liquidity depth and the imbalance in supply and demand across different pools, which are key problems of DeFi. CivTrade is not subject to the algorithms of pool rebalancing and slippage of the AMM that are causing increasing levels of complexity for traders after the launch of Uniswap v3 in May 2021.

Last updated

Was this helpful?