Price Impact

CivTrade innovates DeFi trading: start multiplying your gains today!

Liquidity pools

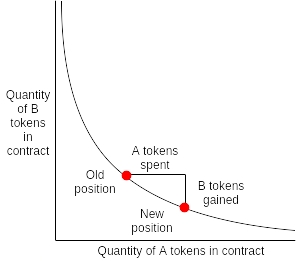

A decentralized exchange like Uniswap or Shibaswap consists of one or more liquidity pools for a trading pair. A liquidity pool is an automated, immutable smart contract that holds reserves of both tokens and allows anyone to swap against them, meaning they can be deposited and withdrawn according to the predetermined rules laid out in the contract.

Unlike a centralized exchange like Binance, which matches buyers and sellers using a traditional orderbook, these DEX liquidity pools act as an automated market maker, governed by the “constant product” formula,

with x and y representing the two reserve tokens. In order to withdraw some amount of token A, one must deposit a proportional amount of token B to maintain k, “constant”, before fees.

Introducing price impact

From the constant product formula, it follows that the price of token A is:

Let’s look at a real-world example: if there were 2,700 WBTC and 86,000 ETH in Uniswap’s ETH/WBTC pool, this reserve ratio would indicate that ETH’s market price at the time was 0.0314 WBTC.

The AMM does not always promptly update this price in response to other markets moving around it. The market price actually changes every time you trade a DEX pair, because that causes the relative reserve ratio of the two tokens in the liquidity pool to change. This is the price impact of your DEX trade!

Thus, price impact depends on the size of your trade relative to the size of the liquidity pool. If you have a small trade against a large liquidity pool, the price impact is negligible; however, if a large trade relative to a small liquidity pool (typical with new tokens) is executed, then the price impact of each trade will be much more significant.

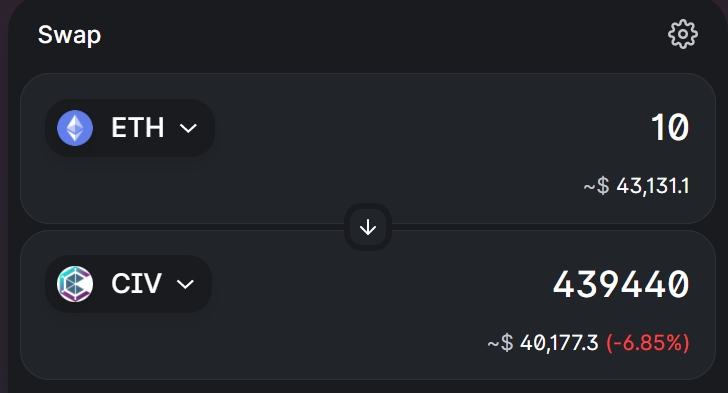

For instance, if you wanted to buy 10 ETH worth of CIV, you would incur a 6.85% price impact. Meaning that you receive $3,000 less than you put into the trade!

Reducing Price Impact

Price impact is often the largest fee DEX traders incur, so how can it be minimized?

Max liquidity: find the pool that has the most liquidity in the price range you care about, or use an aggregation service like 1inch to spread your trade across all the available DEX pools that offer an optimal yield.

Diversification: search for available centralized exchanges to execute part of the transaction, spreading the volume to multiple different sources of liquidity while paying attention to the total trading fee incurred.

DEXs charge a liquidity fee of 0.30%, which translates to a spread of 0.6% between the best buy order and the best sell order. In other words, even the most liquid AMM trade has an implicit 0.3% price impact.

CivTrade eliminates your price impact

Does CIVTrade buy the token across all pools in order to minimize price impact? No, CIVTrade is not a DeFi aggregator!

In order to achieve zero price impact when purchasing your target token, CIVTrade opens a custom-designed one-sided liquidity pool on Uniswap v3, within a defined, narrow range around your target price.

Let’s unpack this a little. Let’s assume you want to buy CIV using ETH as the exchange token. With CivTrade, the impermanent loss generated by the imbalance of the number of CIV tokens in the ETH/CIV pool is actually as the defining feature used to your benefit in order to execute your transaction. You deposit ETH, and upon completion of the transaction, you receive the exact number of CIV tokens at the target price you ordered. The swap becomes a permanent gain!

Your Benefits

CivTrade safely turns you into a professional liquidity provider behind the scenes: not only are you not subject to the 0.3% commission on your transaction, but rather you automatically earn liquidity fees from each trader trading against your pool. Significant gains with zero effort.

Furthermore, not only are you yourself safe from any bot attacks, but imagine if someone trading against the pool your position is in was subject to a sandwich attack by front-running bots, which are unfortunately so common in DEX: CivTrade but it positions you to benefit from this scenario, since it generates additional commissions that would then be allocated to your liquidity pool.

To sum it all up, not only will you not be subject to any slippage or liquidity fees or risk of bot attacks, but also you will earn fees and enjoy zero price impact: 100% guarantee that your trade will only be executed at the exact target price you have chosen.

Last updated

Was this helpful?