Liquidity Fees

CivTrade innovates DeFi trading: start multiplying your gains today!

Decentralized liquidity pools

Centralized Exchanges (CEX) are characterized by order books made of all the bid and ask orders placed by traders. Automated Market Maker (AMM) systems of Decentralized Exchanges (DEX), on the other hand, do not have any order book, relying instead on liquidity pools which are pre-funded token reserves, readily available for users to trade against, using the smart contract of the DEX in which they are deposited.

Therefore, the token reserves you deposit on a DEX (like Uniswap) is essentially what makes it capable of offering you instant automated trading. No reserves, no swaps! And in exchange for your deposit, the DEX pays you fees from each trade (swap) it executes.

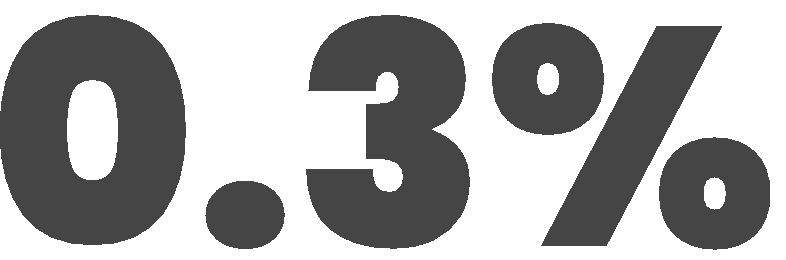

Typical liquidity fee paid on DEX swaps

Liquidity pools are pre-deposited tokens that you can trade against. For instance, if you wanted to swap ETH for CIV (amazing choice, by the way!), your trade taps into the ETH/CIV liquidity pool by adding ETH and removing CIV, based on the current price of CIV (which is determined algorithmically). The relative ratio of the token amounts determines the current price: as the ratio changes, the price also changes, so if you add ETH and remove CIV, the price of CIV goes up.

Liquidity Providers (LPs) deposit initial tokens into liquidity pools to make trading possible. They benefit from taking on this risk by earning a yield on the token they deposited, which is seen by the regular trader as “liquidity provider fee.” The very essence of and what makes DEXs unique is the fact that anyone can become an LP and make the market simply by depositing their token into a pool.

Liquidity fees

At the same time, the orders placed by DEX traders execute seamlessly without the need for any centralized market maker manually providing liquidity, as happens on a centralized exchange like Coinbase or Binance. On a DEX, orders are executed automatically by a blockchain smart contract that calculates trade prices algorithmically, based on the token reserves in the pool.

So why would you want to provide liquidity to a pool? To earn fees from each trade of the selected token pair! In order to incentivize users to add liquidity, DEXs allow LPs to earn trading fees on their platform by rewarding the lock-up of funds. Uniswap currently charges fees for each trade. The fees are then payed to Liquidy providers. Uniswap currently operates with a fee of 0.3% of the input amount as a reward to liquidity providers for every DEX trade.

But not with CivTrade …

CivTrade earns you liquidity fees

How can you avoid liquidity fees on Decentralized Exchanges?

CivTrade is the answer!

Let’s assume you want to buy CIV using ETH as the exchange token. CivTrade opens a one-sided liquidity pool on Uniswap v3 on your behalf and it safely turns you into a professional liquidity provider behind the scenes. One-sided means that, unlike traditional liquidity pairs, we deposit just a single token in your pool.

With CivTrade, not only are you not subject to the 0.3% fee on your transaction, but also you earn liquidity fees from each counterparty automatically trading against your pool. Significant gains, zero effort.

And it gets even better. By turning you into a liquidity provider without any of the complexity, CivTrade guarantees you a higher number of tokens in exchange for your ETH, while also protecting you from slippage and front-running bots.

Last updated

Was this helpful?